As 2026 begins, a significant financial update has emerged in the United States, referred to as the “2000 Direct Deposit IRS Alert.” This essentially means that the IRS (Internal Revenue Service) is directly depositing up to $2000 into the bank accounts of certain eligible taxpayers and beneficiaries. This amount isn’t limited to a single specific program; it could include tax refunds, outstanding tax credits, or payments related to government relief programs. Many are viewing this as a form of economic relief, especially during a time of rising inflation and increasing daily expenses.

Table of Contents

What “Payment Windows Opened” Really Means

When the IRS states that payment windows have opened, it means that the official process of sending payments has begun. This means that money is being transferred to the accounts of those whose tax files have already been processed and whose bank or address information is correct. This process doesn’t happen in a single day. It typically takes several weeks to systematically distribute payments to millions of eligible individuals. Some people receive the money quickly, while others may have to wait a little longer.

Who is eligible for this $2000 payment?

Not every American citizen will receive this $2000. The IRS determines eligibility based on certain criteria. This generally includes individuals who have filed recent tax returns, whose income falls below a certain threshold, or who have a refund or credit pending in their tax records. Additionally, seniors receiving Social Security, disabled individuals, and those participating in certain government assistance programs may also be eligible for this payment. Your eligibility depends on how your tax and benefit records are recorded in the IRS system.

How Will the Money Be Received?

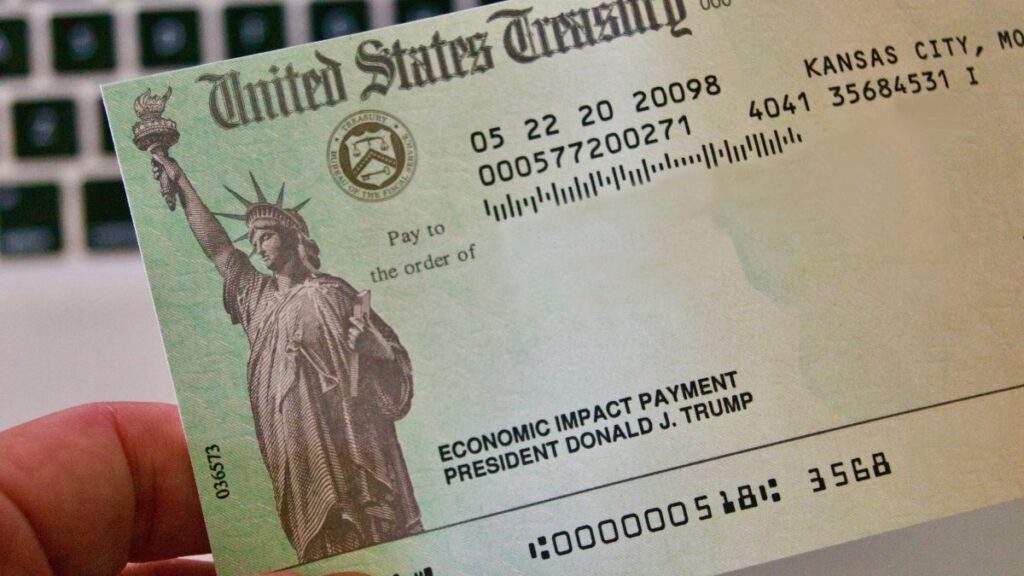

The IRS’s preferred method is direct deposit because it is fast and secure. If you provided your bank account information on your tax return, the $2000 will be sent directly to that account. Those without bank information on file may receive the payment via check or a prepaid debit card. However, these methods may take a little longer, as they involve postal delivery and processing.

How to Check Your Payment Status

If you want to know if your money has been sent, the best way is to visit the official IRS website and log in to your account. There you will find information such as payment status, sending date, and method. Avoid trusting any unfamiliar emails, text messages, or phone calls, as scammers become active during such times and may try to steal your personal information.

What to Do If You Don’t Receive the Money on Time

If the payment window has opened but the money has not yet arrived in your account, first check your bank details and address in your profile. If everything is correct, inquire through the official IRS contact channels. Sometimes, payments are delayed due to technical reasons, identity verification, or missing documents, but providing the correct information usually resolves the issue.

Why This Money Might Be Important to You

The $2000 amount can be a great relief for many families. It can help people easily manage rent, electricity bills, medications, or other essential daily expenses. Especially for those living on a fixed income, this amount can provide some financial stability.

Conclusion

The “2000 Direct Deposit IRS Alert for 2026” is not just news but a sign of real financial assistance for millions of people. The opening of the payment window means the process is underway, and if you are eligible, you will definitely receive this money. It is important to keep your information updated, rely only on official IRS sources, and be patient, as the amount will reach your account in due course.

FAQs

Q. What is the $2000 IRS direct deposit for 2026?

A. It refers to IRS-issued payments such as refunds, credits, or benefit-related payouts sent to eligible individuals.

Q. Will everyone receive the $2000 payment?

A. No, only people who meet IRS eligibility rules based on income, tax filing, or benefit status will qualify.

Q. How will the payment be sent?

A. Most people will receive it by direct deposit, while others may get a paper check or prepaid debit card.

Q. When will payments arrive?

A. Payments are being issued in waves during the open payment window in 2026, not all on the same day.

Q. How can I check my payment status?

A. You can check through your IRS online account or official IRS payment tracking tools.